TODAY IS

Latest topics

LIVE TRAFFIC FEED

THE MOST IMPORTANT NEWS - VIRTUALLY EVERYONE AGREES THAT CURRENT STOCK MARKET VALUATIONS ARE NOT SUSTAINABLE AND THAT A GREAT CRASH IS COMING

END TIME NEWS, A CALL FOR REPENTANCE, YESHUA THE ONLY WAY TO HEAVEN :: CHRISTIANS FOR YESHUA (JESUS) :: END OF THE AMERICAN DREAM, THE ECONOMIC COLLAPSE, THE MOST IMPORTANT NEWS BY MICHAEL SNYDER

Page 1 of 1

THE MOST IMPORTANT NEWS - VIRTUALLY EVERYONE AGREES THAT CURRENT STOCK MARKET VALUATIONS ARE NOT SUSTAINABLE AND THAT A GREAT CRASH IS COMING

THE MOST IMPORTANT NEWS - VIRTUALLY EVERYONE AGREES THAT CURRENT STOCK MARKET VALUATIONS ARE NOT SUSTAINABLE AND THAT A GREAT CRASH IS COMING

Virtually Everyone Agrees That Current Stock Market Valuations Are Not Sustainable And That A Great Crash Is Coming

BY MICHAEL ON FEBRUARY 21, 2017

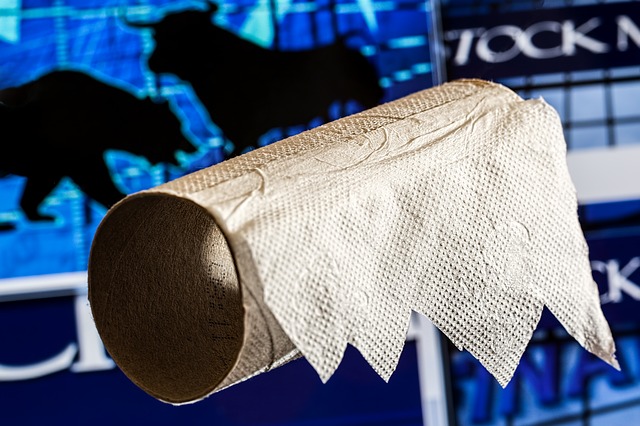

Current stock market valuations are not sustainable. If there is one thing that I want you to remember from this article, it is that cold, hard fact. In 1929, 2000 and 2008, stock prices soared to absolutely absurd levels just before horrible stock market crashes. What goes up must eventually come down, and the stock market bubble of today will be no exception. In fact, virtually everyone in the financial community acknowledges that stock prices are irrationally high right now. Some are suggesting that there is still time to jump in and make money before the crash comes, while others are recommending a much more cautious approach. But what almost everyone agrees on is the fact that stocks cannot go up like this forever.

On Tuesday, the Dow, the S&P 500 and the Nasdaq all set brand new record highs once again. Overall, U.S. stocks are now up more than 10 percent since the election, and this is probably the greatest post-election stock market rally in our entire history.

But stocks were already tremendously overvalued before the election, and at this point stock prices have reached a level of ridiculousness only matched a couple of times before in the past 100 years.

Only the most extreme optimists will try to tell you that stock prices can stay this disconnected from economic reality indefinitely. We are in the midst of one of the most outrageous stock market bubbles of all time, and as MarketWatch has noted, all stock market bubbles eventually burst…

The U.S. stock market at this level reflects a combination of great demand, great complacency, and great greed. Stocks are clearly in a bubble, and like all bubbles, this one is about to burst.

If corporations were making tremendous amounts of money, rapidly rising stock prices would make logical sense.

But that is not the case at all. Corporate earnings for the fourth quarter of 2016 were actually quite dismal, and this disconnect between Wall Street and economic reality is starting to really bug financial analysts such as Brian Sozzi…

The S&P 500 has gone 89 straight sessions without a 1% decline. Considering that Corporate America didn’t exactly light up on the top and bottom lines during the fourth quarter, such a streak is rather troublesome. Granted, the stock market is a forward-looking mechanism that appears to be trading on hopes that Trump’s unannounced stimulus and tax plans will be lifting economic growth in 2018. Even so, the inability of investors to at least acknowledge persistent struggles among companies and ongoing chaos in Washington is starting to become disturbing.

It is a basic fact of economics that stock prices should accurately reflect current and future earnings.

So if corporate earnings are at the same level they were at in 2011, why has the S&P 500 risen by 87 percent since then? The following comes from Wolf Richter…

The S&P 500 stock index edged up to an all-time high of 2,351 on Friday. Total market capitalization of the companies in the index exceeds $20 trillion. That’s 106% of US GDP, for just 500 companies! At the end of 2011, the S&P 500 index was at 1,257. Over the five-plus years since then, it has ballooned by 87%!

These are superlative numbers, and you’d expect superlative earnings performance from these companies. Turns out, reality is not that cooperative. Instead, net income of the S&P 500 companies is now back where it first had been at the end of 2011.

The cyclically adjusted price-to-earnings ratio was originally created by author Robert Shiller, and it is widely regarded as one of the best measures of the true value of stocks in existence. According to the Guardian, there have only been two times in our entire history when this ratio has been higher. One was just before the stock market crash of 1929, and the other was just before the bursting of the dotcom bubble…

Traditionally, one of the best yardsticks for whether shares are over-valued or under-valued has been the cyclically adjusted price earnings ratio constructed by the economist Robert Shiller. This ratio is currently at about 29 and has only twice been higher: in 1929 ahead of the Wall Street Crash, and in the last frantic months of the dotcom bubble of the late 1990s.

We can definitely wish for the current euphoria on Wall Street to last for as long as possible, but let there be absolutely no doubt that it is going to end at some point.

It would take a market decline of 40 or 50 percent to get the cyclically adjusted price-to-earnings ratio back to a level that makes economic sense. Let us hope that the market does not make such a violent move very rapidly, because that would likely be absolutely crippling for our financial system.

Markets tend to go down a lot faster than they go up, and every other major stock market bubble in U.S. history has ended very badly.

And this bubble is definitely overdue to burst. The bull market that led up to the great crash of 1929 lasted for 2002 days, and this week the current bull market will finally exceed that record.

Trying to pick a specific date for a market crash is typically a fruitless exercise, but market watchers are becoming very concerned about some of the signs that we are now seeing. For example, the “CCT indicator” is currently showing “the lowest bullish energy ever”…

The first factor is the CCT indicator. This indicator is a proprietary internal measurement of the general volume of the New York Stock Exchange. The measurements take into account the institutional participation as a ratio of the overall volume. Also measured is the duration of heavy block buying in rallies.

The sum total of all the measurements now shows the lowest bullish energy ever — even lower than in 2008, just before the market crash.

In other words, this current bull market appears to be completely and utterly exhausted.

The laws of economics cannot be defied forever. Traditionally, commodity prices and stock prices have tended to move in unison. And this makes perfect sense, because commodity prices tend to rise when economic conditions are good, and in such an environment stock prices are typically going to move up.

But now we are in a time when commodity prices and stock prices have become completely disconnected. In order to bring this ratio back into line, the S&P 500 would need to fall by about 1000 points, and such a decline would cause a level of financial chaos that would be absolutely unprecedented.

This current stock market bubble has lasted much longer than many of the experts originally anticipated, but that just means that the eventual crash will likely be that much more devastating.

In the end, you don’t need to know all of the technical details in this article.

But what you do need to know is that current stock market valuations are not sustainable and that a great crash is coming.

It may not happen next week or next month, but it is going to happen. And when it does happen, it is likely to make what happened in 2008 look like a Sunday picnic.

FOR MORE ON THIS ARTICLE, PLEASE VISIT: http://themostimportantnews.com/archives/virtually-everyone-agrees-that-current-stock-market-valuations-are-not-sustainable-and-that-a-great-crash-is-coming

Similar topics

Similar topics» THE MOST IMPORTANT NEWS - LEGENDARY INVESTOR JIM ROGERS WARNS THAT THE WORST STOCK MARKET CRASH IN YOUR LIFETIME IS COMING "THIS YEAR OR NEXT"

» THE MOST IMPORTANT NEWS - THE NEXT STOCK MARKET CRASH WILL BE BLAMED ON DONALD TRUMP BUT IT WILL BE THE FEDERAL RESERVE'S FAULT INSTEAD

» THE MOST IMPORTANT NEWS - MEMBER OF CONGRESS WARNS OF A 1,000 POINT STOCK MARKET CRASH IF OBAMACARE LITE DOES NOT PASS

» THE MOST IMPORTANT NEWS - HOW THE FEDERAL RESERVE IS SETTING UP TRUMP FOR A RECESSION, A HOUSING CRISIS AND A STOCK MARKET CRASH

» THIS 2 DAY STOCK MARKET CRASH WAS LARGER THAN ANY 1 DAY STOCK MARKET CRASH IN U.S. HISTORY

» THE MOST IMPORTANT NEWS - THE NEXT STOCK MARKET CRASH WILL BE BLAMED ON DONALD TRUMP BUT IT WILL BE THE FEDERAL RESERVE'S FAULT INSTEAD

» THE MOST IMPORTANT NEWS - MEMBER OF CONGRESS WARNS OF A 1,000 POINT STOCK MARKET CRASH IF OBAMACARE LITE DOES NOT PASS

» THE MOST IMPORTANT NEWS - HOW THE FEDERAL RESERVE IS SETTING UP TRUMP FOR A RECESSION, A HOUSING CRISIS AND A STOCK MARKET CRASH

» THIS 2 DAY STOCK MARKET CRASH WAS LARGER THAN ANY 1 DAY STOCK MARKET CRASH IN U.S. HISTORY

END TIME NEWS, A CALL FOR REPENTANCE, YESHUA THE ONLY WAY TO HEAVEN :: CHRISTIANS FOR YESHUA (JESUS) :: END OF THE AMERICAN DREAM, THE ECONOMIC COLLAPSE, THE MOST IMPORTANT NEWS BY MICHAEL SNYDER

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum

Sun 29 Aug 2021, 22:15 by Jude

Sun 29 Aug 2021, 22:15 by Jude