TODAY IS

Latest topics

LIVE TRAFFIC FEED

ZERO HEDGE - WHAT'S BEHIND THE COLLAPSE IN GLOBAL EXPORTS?

END TIME NEWS, A CALL FOR REPENTANCE, YESHUA THE ONLY WAY TO HEAVEN :: CHRISTIANS FOR YESHUA (JESUS) :: ZERO HEDGE

Page 1 of 1

ZERO HEDGE - WHAT'S BEHIND THE COLLAPSE IN GLOBAL EXPORTS?

ZERO HEDGE - WHAT'S BEHIND THE COLLAPSE IN GLOBAL EXPORTS?

What's Behind The Collapse In Global Exports?

by Tyler Durden

Jan 27, 2017 1:28 PM

Submitted by Michael Shedlock via MishTalk.com,

Global export of goods (priced in US dollars) has collapsed in Japan, the EU, and emerging markets, since their recovery highs following the great recession.

The US is the best of the lot, but US exports of goods are down substantially as well.

What’s behind the move? Is it protectionism? Currency related? Take a guess before reading further. The answer is coming up.

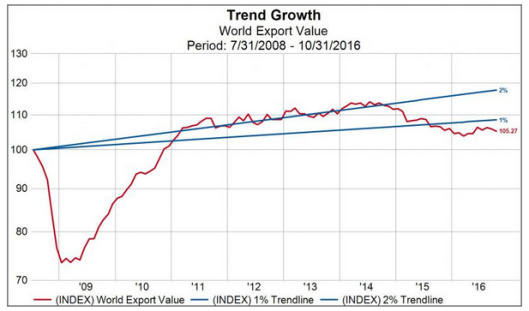

I got to thinking about the above questions after following a Gavekal Capital tweet that World Trade has Increased by Less Than 1% Annually Since 7/07.

Gavekal Explanation

There are fears that the world is on the precipice of turning back the clock on globalization. In some ways, the case can be made globalization has been retreating since the financial crisis. One of the strongest supporting data points of that argument is world trade data. According to the CPB World Trade Monitor, the value of world exports (volume * price) has increased by less than 1% annually since making a high on 7/31/2007 compared to more than a 5% annualized growth rate since 1991 (beginning of the data series). If we look at just volume data, the story doesn’t improve very much. World export volume has increased at less than 1.5% annually since 7/31/2007. This is about 1/3 of the annual growth rate world export volumes has increased by since 1991. Even with extraordinary global monetary easing in the post financial crisis world, world trade has been unable to find the extra gear it hit during the pre-crisis era.

That explanation sounded quite reasonable when I first read it, but I wanted to see how the US fared vs. the rest of the world.

After I downloaded then plotted the data, I came up with a completely different answer.

Global Exports January 2000 to November 2016

Global exports priced in US dollars has varied directly with the price of oil. Protectionism had not kicked in yet, but it will.

Falling currencies are supposed to lift exports but take a look at sorry Japan. Outside the Mideast (the CPB lumps Africa with the Mideast), Japan is the worst of the lot.

Export Collapse Since Recovery Peak

In the above table, WTIC is the price of West Texas Intermediate Crude.

The Mideast correlated nearly 1-1 to the price of oil because oil is essentially the Mideast’s only export.

Currency Factor

Conventional wisdom says a rising currency is bad for exports and a sinking currency is good for exports. Yet …

Despite a strong dollar, the US has fared the best in exports percentage-wise since November 2011.

Despite a 31.8% collapse in the price of the Yen vs. the US dollar, Japanese exports fell 28.1%.

Looking Ahead Questions

Is a global trade bust coming?

Will a global trade bust mean another decline in the price of oil as well?

I believe Trump’s massively protectionist policies will lead to a huge decline in trade. If so, the above chart suggests it will likely be accompanied by another oil bust as well.

FOR MORE ON THIS ARTICLE, PLEASE VISIT: http://www.zerohedge.com/news/2017-01-27/whats-behind-collapse-global-exports

by Tyler Durden

Jan 27, 2017 1:28 PM

Submitted by Michael Shedlock via MishTalk.com,

Global export of goods (priced in US dollars) has collapsed in Japan, the EU, and emerging markets, since their recovery highs following the great recession.

The US is the best of the lot, but US exports of goods are down substantially as well.

What’s behind the move? Is it protectionism? Currency related? Take a guess before reading further. The answer is coming up.

I got to thinking about the above questions after following a Gavekal Capital tweet that World Trade has Increased by Less Than 1% Annually Since 7/07.

Gavekal Explanation

There are fears that the world is on the precipice of turning back the clock on globalization. In some ways, the case can be made globalization has been retreating since the financial crisis. One of the strongest supporting data points of that argument is world trade data. According to the CPB World Trade Monitor, the value of world exports (volume * price) has increased by less than 1% annually since making a high on 7/31/2007 compared to more than a 5% annualized growth rate since 1991 (beginning of the data series). If we look at just volume data, the story doesn’t improve very much. World export volume has increased at less than 1.5% annually since 7/31/2007. This is about 1/3 of the annual growth rate world export volumes has increased by since 1991. Even with extraordinary global monetary easing in the post financial crisis world, world trade has been unable to find the extra gear it hit during the pre-crisis era.

That explanation sounded quite reasonable when I first read it, but I wanted to see how the US fared vs. the rest of the world.

After I downloaded then plotted the data, I came up with a completely different answer.

Global Exports January 2000 to November 2016

Global exports priced in US dollars has varied directly with the price of oil. Protectionism had not kicked in yet, but it will.

Falling currencies are supposed to lift exports but take a look at sorry Japan. Outside the Mideast (the CPB lumps Africa with the Mideast), Japan is the worst of the lot.

Export Collapse Since Recovery Peak

In the above table, WTIC is the price of West Texas Intermediate Crude.

The Mideast correlated nearly 1-1 to the price of oil because oil is essentially the Mideast’s only export.

Currency Factor

Conventional wisdom says a rising currency is bad for exports and a sinking currency is good for exports. Yet …

Despite a strong dollar, the US has fared the best in exports percentage-wise since November 2011.

Despite a 31.8% collapse in the price of the Yen vs. the US dollar, Japanese exports fell 28.1%.

Looking Ahead Questions

Is a global trade bust coming?

Will a global trade bust mean another decline in the price of oil as well?

I believe Trump’s massively protectionist policies will lead to a huge decline in trade. If so, the above chart suggests it will likely be accompanied by another oil bust as well.

FOR MORE ON THIS ARTICLE, PLEASE VISIT: http://www.zerohedge.com/news/2017-01-27/whats-behind-collapse-global-exports

Similar topics

Similar topics» ZERO HEDGE - "A WEEK LATER THEY'RE DEAD" - FOMC TRANSCRIPTS REVEAL HOW THE FED WATCH MF GLOBAL COLLAPSE

» CHINESE EXPORTS PLUNGE 11.2 PERCENT AS ECONOMIC ACTIVITY CONTINUES TO COLLAPSE ALL OVER THE PLANET

» ZERO HEDGE - GREECE IS IN TROUBLE AGAIN: BONDS, STOCKS PLUNGE AS BAILOUT TALKS COLLAPSE; IMF SEES "EXPLOSIVE" DEBT

» ZERO HEDGE - DOW SET TO OPEN ON VERGE OF 20,000 AS TRUMP TRADE SENDS GLOBAL STOCKS TO 19 MONTH HIGHS

» RED ALERT: PROOF THAT A GLOBAL ECONOMIC COLLAPSE IS VERY NEAR

» CHINESE EXPORTS PLUNGE 11.2 PERCENT AS ECONOMIC ACTIVITY CONTINUES TO COLLAPSE ALL OVER THE PLANET

» ZERO HEDGE - GREECE IS IN TROUBLE AGAIN: BONDS, STOCKS PLUNGE AS BAILOUT TALKS COLLAPSE; IMF SEES "EXPLOSIVE" DEBT

» ZERO HEDGE - DOW SET TO OPEN ON VERGE OF 20,000 AS TRUMP TRADE SENDS GLOBAL STOCKS TO 19 MONTH HIGHS

» RED ALERT: PROOF THAT A GLOBAL ECONOMIC COLLAPSE IS VERY NEAR

END TIME NEWS, A CALL FOR REPENTANCE, YESHUA THE ONLY WAY TO HEAVEN :: CHRISTIANS FOR YESHUA (JESUS) :: ZERO HEDGE

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum

Sun 29 Aug 2021, 22:15 by Jude

Sun 29 Aug 2021, 22:15 by Jude