TODAY IS

Latest topics

LIVE TRAFFIC FEED

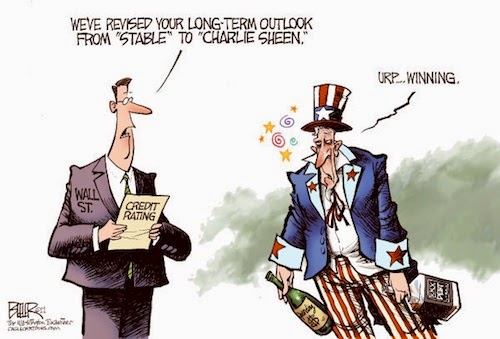

THE ECONOMY: OUR JUNKIE ECONOMY" WILL SOON HIT ROCK BOTTOM

END TIME NEWS, A CALL FOR REPENTANCE, YESHUA THE ONLY WAY TO HEAVEN :: CHRISTIANS FOR YESHUA (JESUS) :: RECESSION, ECONOMIC CRISIS, FINANCIAL MELTDOWNS, MONEY WOES

Page 1 of 1

THE ECONOMY: OUR JUNKIE ECONOMY" WILL SOON HIT ROCK BOTTOM

THE ECONOMY: OUR JUNKIE ECONOMY" WILL SOON HIT ROCK BOTTOM

TUESDAY, MAY 19, 2015

The Economy: "Our “Junkie Economy” Will Soon Hit Rock Bottom"

"Our “Junkie Economy” Will Soon Hit Rock Bottom"

by Bill Bonner

Medellín, Colombia - "This is the first time we’ve been in Colombia. Greener, more mountainous, richer, newer, and more flowery – it is many things we didn’t expect. We’ve seen a lot of press on Medellín. It is supposed to be lively. It is “springtime all year round.” It is beautiful. And it is a lot safer now than when drug kingpin Pablo Escobar called it home. We haven’t been here long enough to know if those things are true. All we know so far is that it is so modern, so big, and so wealthy that we are a bit disappointed. We’d expected a bit more charm and authentic poverty. Maybe they are on the other side of town… we don’t know. We’ll let you know if we find out anything more…

Addicted to Debt: Yesterday, U.S. stocks continued their climb, with a 26-point step-up to yet another all-time high for the Dow. Treasurys, meanwhile, continued to sell off. The yield on the 10-year T-note – which moves in the opposite direction to prices – rose 8 basis points to 2.2%. This follows last week’s turbulent action in the bond market, which saw Treasury yields hit a six-month high.

We have our eye on the U.S. bond market. Prices have been going up – and yields have been going down – for 32 years. And as prices have risen to the highest levels ever recorded, so has the amount of debt. It is as though the world couldn’t get enough of the stuff. It got to be like heroin: The more debt the world took on, the more it wanted… and the bigger the dose it needed to get a buzz on. But after the 2008 credit crisis, it is as though the major developed economies are immune to the stuff.

The Fed, the Bank of England, the Bank of Japan, and now the European Central Bank, have been buying it on the street corners. In the largest quantities ever. But nothing much happens. At least, not in the real economy. Sooner or later (a phrase we can’t seem to avoid), the entire economy is bound to get the shakes. But we don’t know when sooner, or later, will come. If it comes now, it will be a source of great satisfaction here at the Diary. “Finally,” we will say to no one in particular. “We knew it couldn’t last!”

A Healthy End to the Bond Bull? There is an alternative explanation for falling bond prices. Bond prices should fall, and yields should rise, when economic growth picks up. As economic growth rates speed up, wages tend to rise… and people open up their wallets. Demand starts to outstrip the supply of goods and services. This drives up consumer prices. And interest rates start to rise. As rates go up, that raises bond yields and drives down bond prices.

This would be a healthy end to the epic bull market in bonds. A robust economy would allow central banks to raise rates and still allow debts to be paid down. But that is not what is happening. And it won’t happen. Junkies rarely go out and get a job… and gradually “taper off” their habit. No. They have to crash… hit bottom… and sink into such misery that they have no choice but to go cold turkey.

Now, major central banks are committed to QE and ZIRP forever. They have created an economy that is addicted to EZ money. It will have to be smashed to smithereens before the feds change their policies.

An Impotent Fed: As colleague Chris Hunter reported yesterday: "In April, industrial production fell for the fifth straight month. And in May, consumer sentiment fell to a seven-month low. And now GDP growth is flat-lining… Following the 0.1% annualized growth rate in the first quarter, the Atlanta Fed’s “real-time” GDPNow forecasting model is predicting 0.7% growth for the second quarter. The U.S. economy may not be in an official recession – often measured by two back-to-back quarters of negative GDP growth – but it’s not far off…"

Oh, but what about the big boost the economy was supposed to get from lower oil prices? What happened to that? Didn’t happen. Americans didn’t spend their gasoline savings; they saved them instead. After adjusting for inflation, the median household income is down 10% since 2000. So it’s no wonder most Americans aren’t feeling very expansive. And now, the price of oil is going back up. After hitting a low of $44 in March, today a barrel of U.S. crude oil sells for just under $59.

That leaves the Fed’s “stimulus” just as impotent as it has been for the last six years. Interest rates remain ultra low. But the real economy remains as flat and dull as a joint session of Congress. And the markets shudder…"

- http://www.thedailyreckoning.com

POSTED BY COYOTEPRIME AT 11:46 AM

FOR MORE INFORMATION PLEASE CLICK HERE.

The Economy: "Our “Junkie Economy” Will Soon Hit Rock Bottom"

"Our “Junkie Economy” Will Soon Hit Rock Bottom"

by Bill Bonner

Medellín, Colombia - "This is the first time we’ve been in Colombia. Greener, more mountainous, richer, newer, and more flowery – it is many things we didn’t expect. We’ve seen a lot of press on Medellín. It is supposed to be lively. It is “springtime all year round.” It is beautiful. And it is a lot safer now than when drug kingpin Pablo Escobar called it home. We haven’t been here long enough to know if those things are true. All we know so far is that it is so modern, so big, and so wealthy that we are a bit disappointed. We’d expected a bit more charm and authentic poverty. Maybe they are on the other side of town… we don’t know. We’ll let you know if we find out anything more…

Addicted to Debt: Yesterday, U.S. stocks continued their climb, with a 26-point step-up to yet another all-time high for the Dow. Treasurys, meanwhile, continued to sell off. The yield on the 10-year T-note – which moves in the opposite direction to prices – rose 8 basis points to 2.2%. This follows last week’s turbulent action in the bond market, which saw Treasury yields hit a six-month high.

We have our eye on the U.S. bond market. Prices have been going up – and yields have been going down – for 32 years. And as prices have risen to the highest levels ever recorded, so has the amount of debt. It is as though the world couldn’t get enough of the stuff. It got to be like heroin: The more debt the world took on, the more it wanted… and the bigger the dose it needed to get a buzz on. But after the 2008 credit crisis, it is as though the major developed economies are immune to the stuff.

The Fed, the Bank of England, the Bank of Japan, and now the European Central Bank, have been buying it on the street corners. In the largest quantities ever. But nothing much happens. At least, not in the real economy. Sooner or later (a phrase we can’t seem to avoid), the entire economy is bound to get the shakes. But we don’t know when sooner, or later, will come. If it comes now, it will be a source of great satisfaction here at the Diary. “Finally,” we will say to no one in particular. “We knew it couldn’t last!”

A Healthy End to the Bond Bull? There is an alternative explanation for falling bond prices. Bond prices should fall, and yields should rise, when economic growth picks up. As economic growth rates speed up, wages tend to rise… and people open up their wallets. Demand starts to outstrip the supply of goods and services. This drives up consumer prices. And interest rates start to rise. As rates go up, that raises bond yields and drives down bond prices.

This would be a healthy end to the epic bull market in bonds. A robust economy would allow central banks to raise rates and still allow debts to be paid down. But that is not what is happening. And it won’t happen. Junkies rarely go out and get a job… and gradually “taper off” their habit. No. They have to crash… hit bottom… and sink into such misery that they have no choice but to go cold turkey.

Now, major central banks are committed to QE and ZIRP forever. They have created an economy that is addicted to EZ money. It will have to be smashed to smithereens before the feds change their policies.

An Impotent Fed: As colleague Chris Hunter reported yesterday: "In April, industrial production fell for the fifth straight month. And in May, consumer sentiment fell to a seven-month low. And now GDP growth is flat-lining… Following the 0.1% annualized growth rate in the first quarter, the Atlanta Fed’s “real-time” GDPNow forecasting model is predicting 0.7% growth for the second quarter. The U.S. economy may not be in an official recession – often measured by two back-to-back quarters of negative GDP growth – but it’s not far off…"

Oh, but what about the big boost the economy was supposed to get from lower oil prices? What happened to that? Didn’t happen. Americans didn’t spend their gasoline savings; they saved them instead. After adjusting for inflation, the median household income is down 10% since 2000. So it’s no wonder most Americans aren’t feeling very expansive. And now, the price of oil is going back up. After hitting a low of $44 in March, today a barrel of U.S. crude oil sells for just under $59.

That leaves the Fed’s “stimulus” just as impotent as it has been for the last six years. Interest rates remain ultra low. But the real economy remains as flat and dull as a joint session of Congress. And the markets shudder…"

- http://www.thedailyreckoning.com

POSTED BY COYOTEPRIME AT 11:46 AM

FOR MORE INFORMATION PLEASE CLICK HERE.

Similar topics

Similar topics» THE ECONOMIC COLLAPSE - FROM AN INDUSTRIAL ECONOMY TO A PAPER ECONOMY - THE STUNNING DECLINE OF MANUFACTURING IN AMERICA

» THREE KEY INDICATORS SAY THE U. S. ECONOMY IS IN TROUBLE

» END TIME ECONOMY

» THE ECONOMY IS MORE FRAGILE THAN EVER

» PEACE ROCK

» THREE KEY INDICATORS SAY THE U. S. ECONOMY IS IN TROUBLE

» END TIME ECONOMY

» THE ECONOMY IS MORE FRAGILE THAN EVER

» PEACE ROCK

END TIME NEWS, A CALL FOR REPENTANCE, YESHUA THE ONLY WAY TO HEAVEN :: CHRISTIANS FOR YESHUA (JESUS) :: RECESSION, ECONOMIC CRISIS, FINANCIAL MELTDOWNS, MONEY WOES

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum

Sun 29 Aug 2021, 22:15 by Jude

Sun 29 Aug 2021, 22:15 by Jude