TODAY IS

Latest topics

LIVE TRAFFIC FEED

TWO-THIRDS OF US MILLIONAIRES FEAR "THEY WILL LOSE IT ALL" IF THE MARKET CRASHES

END TIME NEWS, A CALL FOR REPENTANCE, YESHUA THE ONLY WAY TO HEAVEN :: CHRISTIANS FOR YESHUA (JESUS) :: RECESSION, ECONOMIC CRISIS, FINANCIAL MELTDOWNS, MONEY WOES

Page 1 of 1

TWO-THIRDS OF US MILLIONAIRES FEAR "THEY WILL LOSE IT ALL" IF THE MARKET CRASHES

TWO-THIRDS OF US MILLIONAIRES FEAR "THEY WILL LOSE IT ALL" IF THE MARKET CRASHES

Two-Thirds Of US Millionaires Fear "They Will Lose It All" If The Market Crashes

Tyler Durden's pictureSubmitted by Tyler Durden on 05/04/2015 18:14 -0400

Gambling HFT Market Crash New Normal Quote Stuffing Reality St Louis Fed St. Louis Fed

It's not easy being a millionaire in the New Normal.

No really, because even though over the past 7 years every single Fed action has catered exclusively to the wealthiest 1% within polite US society, desperate to make them wealthier in hopes their combined trilions in net worth will magically "

"trickle down", according to another voyeristic UBS study into America's high net worth public, while "millionaires enjoy a great deal of happiness and appreciation for what they’ve earned... many feel compelled to strive for more, spurred on by their own ambition, their desire to protect their families’ lifestyle and an ever-present fear of losing it all. With memories of the financial crisis still lingering, most millionaires don’t have enough wealth to feel secure. As a result, many feel stuck on a treadmill, without a real sense of how much wealth would make them satisfied enough to get off."

It gets better.

UBS observers that "Millionaires’ constant striving comes mainly from pressure they feel to maintain the high standard of living they have established for their families, whom they value above all else. At the same time, millionaires worry this very lifestyle may be spoiling their children, causing them to lack motivation and feel entitled."

And so the Fed is also to blame for a whole generation of spoiled Millennials. But the punchline: "Millionaires feel stuck on a treadmill they can’t get off..." The reason:

Though two-thirds of millionaires say achieving financial security is the whole point of working to build wealth, only the very wealthy (those with $5 million or more) feel they have enough to be secure. Half of millionaires with less than $5 million—and 63% of those working with children at home—believe that one wrong move, such as a job loss or market crash, would have a major impact on their lifestyle. For individuals with at least $5 million, only 34% feel they couldn’t withstand a setback.

And so perhaps the biggest irony of the New Paranormal is revealed, one on which the entire failed central planning experiment was built on: by making the wealthy wealthier by means of a rigged, broken, manipulated market which everyone now realizes has zero basis in reality (stocks jump on bad econ data, soar on catastrophic data out of hopes of even more central bank liquidity), or fundamentals (not a day passes without the CFTC, SEC, or some other regulators humiliated by constant HFT spoofing or quote stuffing), they feel compelled to save even more than if the bulk of their wealth had been accumulated using honest means and ways.

In other words, instead of facilitating some mutated trickle down, the Fed succeeded in forcing the most upwardly mobile segment of society to spend as little as possible! And then the St. Louis Fed wonders why the US middle class is disappearing, something we first predicted would happen in 2009.

But what if millionaires had nothing to worry about: what if the Fed could guarantee that the stock market which it nearly singlehandedly tripled from its March 2009 lows would never crash, what would the millionaires above do with all that free time and disposable income?

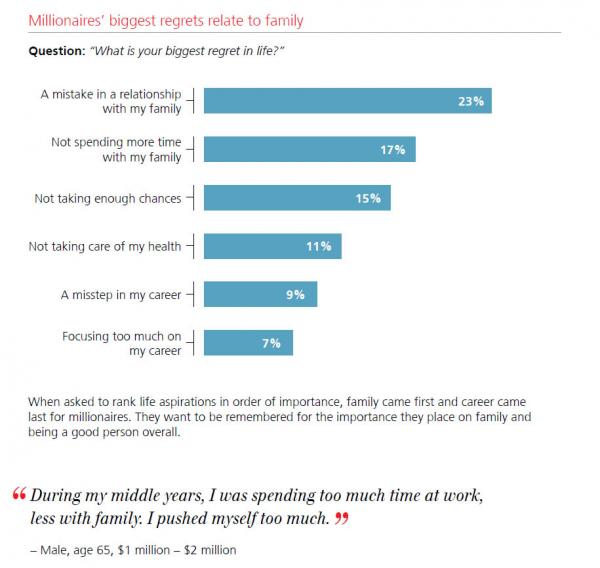

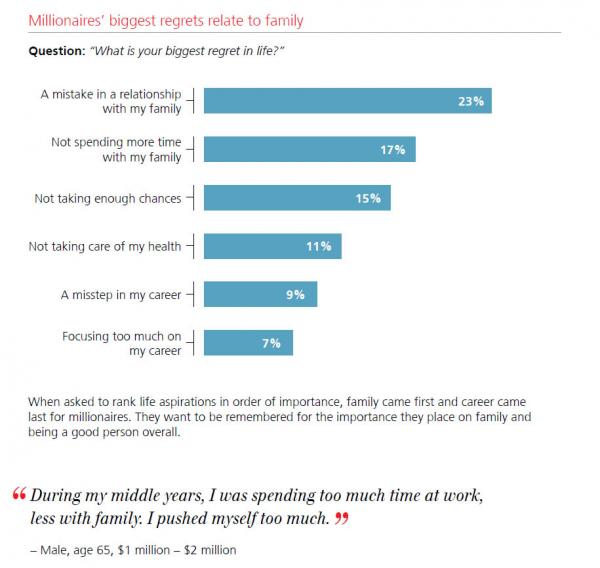

UBS' answer: "the overwhelming majority of millionaires (87%) would do things differently. As much time and energy as they spend on their careers, they would rather enjoy a wider range of experiences, such as traveling and spending time with family. They would also be more likely to take chances, since many regret not taking enough chances in the past. Ultimately, millionaires are unlikely to step off the treadmill unless faced with a major life event (e.g., a health scare, retirement)."

Unclear which of these is "blow it all on hookers."

Oh wait, for the answer we go to the next panel of questions in which we find that "They regret relationship mistakes and not spending enough time with family"

And there it is: if the Fed wants to boost the sagging Vice index which consists of such components as hookers, booze and gambling - which is precisely what the above millionaires would first and foremost spend their money on - all it has to do is assure America's depressed millionaires that the market will never again drop. Ever. Pretty much precisely what it has been doing for the past 7 years.

Tyler Durden's pictureSubmitted by Tyler Durden on 05/04/2015 18:14 -0400

Gambling HFT Market Crash New Normal Quote Stuffing Reality St Louis Fed St. Louis Fed

It's not easy being a millionaire in the New Normal.

No really, because even though over the past 7 years every single Fed action has catered exclusively to the wealthiest 1% within polite US society, desperate to make them wealthier in hopes their combined trilions in net worth will magically "

"trickle down", according to another voyeristic UBS study into America's high net worth public, while "millionaires enjoy a great deal of happiness and appreciation for what they’ve earned... many feel compelled to strive for more, spurred on by their own ambition, their desire to protect their families’ lifestyle and an ever-present fear of losing it all. With memories of the financial crisis still lingering, most millionaires don’t have enough wealth to feel secure. As a result, many feel stuck on a treadmill, without a real sense of how much wealth would make them satisfied enough to get off."

It gets better.

UBS observers that "Millionaires’ constant striving comes mainly from pressure they feel to maintain the high standard of living they have established for their families, whom they value above all else. At the same time, millionaires worry this very lifestyle may be spoiling their children, causing them to lack motivation and feel entitled."

And so the Fed is also to blame for a whole generation of spoiled Millennials. But the punchline: "Millionaires feel stuck on a treadmill they can’t get off..." The reason:

Though two-thirds of millionaires say achieving financial security is the whole point of working to build wealth, only the very wealthy (those with $5 million or more) feel they have enough to be secure. Half of millionaires with less than $5 million—and 63% of those working with children at home—believe that one wrong move, such as a job loss or market crash, would have a major impact on their lifestyle. For individuals with at least $5 million, only 34% feel they couldn’t withstand a setback.

And so perhaps the biggest irony of the New Paranormal is revealed, one on which the entire failed central planning experiment was built on: by making the wealthy wealthier by means of a rigged, broken, manipulated market which everyone now realizes has zero basis in reality (stocks jump on bad econ data, soar on catastrophic data out of hopes of even more central bank liquidity), or fundamentals (not a day passes without the CFTC, SEC, or some other regulators humiliated by constant HFT spoofing or quote stuffing), they feel compelled to save even more than if the bulk of their wealth had been accumulated using honest means and ways.

In other words, instead of facilitating some mutated trickle down, the Fed succeeded in forcing the most upwardly mobile segment of society to spend as little as possible! And then the St. Louis Fed wonders why the US middle class is disappearing, something we first predicted would happen in 2009.

But what if millionaires had nothing to worry about: what if the Fed could guarantee that the stock market which it nearly singlehandedly tripled from its March 2009 lows would never crash, what would the millionaires above do with all that free time and disposable income?

UBS' answer: "the overwhelming majority of millionaires (87%) would do things differently. As much time and energy as they spend on their careers, they would rather enjoy a wider range of experiences, such as traveling and spending time with family. They would also be more likely to take chances, since many regret not taking enough chances in the past. Ultimately, millionaires are unlikely to step off the treadmill unless faced with a major life event (e.g., a health scare, retirement)."

Unclear which of these is "blow it all on hookers."

Oh wait, for the answer we go to the next panel of questions in which we find that "They regret relationship mistakes and not spending enough time with family"

And there it is: if the Fed wants to boost the sagging Vice index which consists of such components as hookers, booze and gambling - which is precisely what the above millionaires would first and foremost spend their money on - all it has to do is assure America's depressed millionaires that the market will never again drop. Ever. Pretty much precisely what it has been doing for the past 7 years.

Ara- Admin

- Join date : 2011-01-19

Location : USA

Similar topics

Similar topics» WHENEVER MARGIN DEBT GOES OVER 2.25% OF GDP THE STOCK MARKET ALWAYS CRASHES

» 23 NATIONS AROUND THE WORLD WHERE STOCK MARKET CRASHES ARE ALREADY HAPPENING

» Dahboo 77 - The Biggest Stock Market Crashes Tend to Happen In October

» STOCK MARKET CRASH OCTOBER 2015? 9 OF THE 16 LARGEST CRASHES IN HISTORY HAVE COME THIS MONTH

» THE MOST IMPORTANT NEWS - WHY ARE SO MANY BIG INVESTORS POSITIONING THEMSELVES TO MAKE GIANT AMOUNTS OF MONEY IF THE STOCK MARKET CRASHES?

» 23 NATIONS AROUND THE WORLD WHERE STOCK MARKET CRASHES ARE ALREADY HAPPENING

» Dahboo 77 - The Biggest Stock Market Crashes Tend to Happen In October

» STOCK MARKET CRASH OCTOBER 2015? 9 OF THE 16 LARGEST CRASHES IN HISTORY HAVE COME THIS MONTH

» THE MOST IMPORTANT NEWS - WHY ARE SO MANY BIG INVESTORS POSITIONING THEMSELVES TO MAKE GIANT AMOUNTS OF MONEY IF THE STOCK MARKET CRASHES?

END TIME NEWS, A CALL FOR REPENTANCE, YESHUA THE ONLY WAY TO HEAVEN :: CHRISTIANS FOR YESHUA (JESUS) :: RECESSION, ECONOMIC CRISIS, FINANCIAL MELTDOWNS, MONEY WOES

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum

Sun 29 Aug 2021, 22:15 by Jude

Sun 29 Aug 2021, 22:15 by Jude