TODAY IS

Latest topics

LIVE TRAFFIC FEED

ZERO HEDGE - BARRON'S: NEXT STOP DOW 30,000 ... ON ONE CONDITION

END TIME NEWS, A CALL FOR REPENTANCE, YESHUA THE ONLY WAY TO HEAVEN :: CHRISTIANS FOR YESHUA (JESUS) :: ZERO HEDGE

Page 1 of 1

ZERO HEDGE - BARRON'S: NEXT STOP DOW 30,000 ... ON ONE CONDITION

ZERO HEDGE - BARRON'S: NEXT STOP DOW 30,000 ... ON ONE CONDITION

Barron's: Next Stop Dow 30,000... On One Condition

by Tyler Durden

Jan 28, 2017 11:08 AM

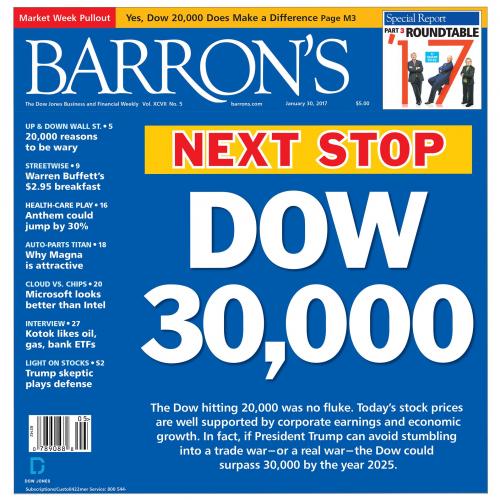

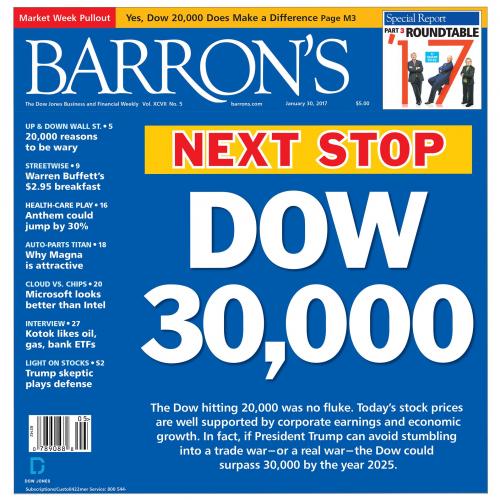

The financial magazine which has made an art out of calling for big, round numbers in the Dow Jones Financial Index (as a reminder over 20% of the Dow's surge since the election is due entirely to Goldman Sachs), most recently with its "get ready for Dow 20,000" call from just over a month ago, has done it again:

While there are still those - pretty much anyone who still cares about fundamentals - who are scratching their heads at Dow20K, according to Barrons "the Dow hitting 20,000 was no fluke. Today’s stock prices are well supported by solid prospects for corporate earnings and economic growth."

In fact, Dow 30,000 is just around the corner... well by 2025. All President Donald Trump has to do, according to Barron's, is "avoid stumbling into a trade war—or a real war." Some of the profound insight behind this forecast so reminiscent of the infamous "Dow 36,000" prediction which hit just around the time of the last market bubble.

Clearly, part of the propulsion behind stocks has been the Trump administration and its flurry of business-friendly edicts. If Trump can succeed in reducing regulation and lowering corporate taxes, stocks should surge further this year. An additional 5% or even 10% gain in 2017 wouldn’t be surprising. Our projection of 30,000 by 2025 is based on our analysis of historical data provided by Jeremy Schwartz, director of research at WisdomTree. This data, which looks at stock market returns for rolling five-year periods dating back to 1871, suggest stock market gains will fall below the market’s typical annual gain of 6% after inflation in the next five years before accelerating above the average in the years after that.

Then again, perhaps Dow 30,000, which would require China to inject in at least another $30 trillion in debt in the next decade without somehow hitting the Minsky moment tipping point, is not so certain: it all depends on whether Trump can avoid war, either literal of metaphorical:

"a few of the new administration’s policies pose a serious threat to the economy and stock market. The most evident one last week was the trade spat with Mexico, with the White House at one point floating the idea of a 20% border tax on Mexican goods entering the U.S. If Trump gambits like this were to trigger a trade war, the world economy would suffer. The Dow would have a hard time getting to 30,000 by 2025."

Alternatively, one can make the argument that a trade, or real war, would guarantee hitting the Dow 30,000 that much quicker: after all, it would force the Fed to resume QE, monetizing not just bonds, but ETFs, equities, and everything else in capital markets in order to preserve confidence in the global financial system.

Ironically, in the same Barron's edition, we also read a more nuanced take of what Dow 20,000 really means from Randall Forsyth who notes says that "while the Dow is the gauge that regular folks use to keep track of the stock market, a columnist in the Financial Times condescendingly called the attainment of the 20,000 mark last week “fake news.” The flaws in the price-weighted DJIA are known to anyone who cares about such things, but it was the best method available to Charles Dow before the turn of the 20th century. As a result of its modus operandi, David Rosenberg, chief economist and strategist at Gluskin Sheff, observes that moves in Goldman Sachs Group (ticker: GS) have eight times the impact on the Dow as those in General Electric (GE).

So-called survivorship bias also has benefited the Dow. Since April 2004, Dave found that, if the eight companies that were replaced in the DJIA had been kept on, the blue chips would have been at just 12,885 now. That date, by the way, is the furthest back he could go to find former Dow companies that are still around. In the process, Apple (AAPL) was added in 2015, after a seven-for-one stock split that prevented the tech giant from having an outsize impact on the DJIA. While Rosenberg notes that tech stocks now account for a quarter of the Dow, up from 2% at the peak of the dot-com boom in 1999, the so-called FANG stocks— Facebook (FB), Amazon.com (AMZN), Netflix (NFLX), and Google parent Alphabet (GOOGL)—wait to be admitted to the blue chips.

Not surprisingly, President Donald Trump was more than willing to take credit for the Dow’s hitting 20,000 five days into his administration (arguably more deserved than President Barack Obama getting the Nobel Peace Prize months after taking office in 2009)—a reversal of his declaration that the market was in a “fat bubble” last September.

To a more dispassionate observer—in this case, Peter Berezin writing in the BCA Research Global Investment Strategy—the shift represented an evolution from undue pessimism about global growth to unbridled optimism.

And, as JPM has warned every single day in the past month, the next step in the market climbing the wall of optimism may be slippery:

The centerpiece of the Trump program—tax cuts and tax reform—can’t be enacted by executive order. That will take approval by Congress. However, the White House has widening rifts with GOP leaders, writes Greg Valliere, chief strategist at Horizon Investments and a four-decade Washington watcher: “Make no mistake—[House Speaker] Paul Ryan and [Senate Majority Leader] Mitch McConnell can’t stand Trump, and the feeling is mutual.”

While the Dow has been happy to stay above 20K for the time being, the next step may be determined by the Fed, which is meeting next week with the S&P over 200 points above where Janet Yellen warned sstocks are overvalued. As the Fed chair said in May 2015, "I would highlight that equity market valuations at this point generally are quite high," Yellen said.

"There are potential dangers there" Yellen said.

And the main one is that Yellen decides to finally pull the rug from under Trump's market honeymoon. As Forsyth writes, "the FOMC could signal its readiness to raise its fed-funds target at the March 14-15 meeting. The fed-funds futures market puts only a 34.6% probability on a March move, according to Bloomberg’s analysis, instead pricing in the next boost for June and another in September, but not in December. The shock for the markets would be if the central bank actually delivers the three rate increases that it has signaled."

Trump was quick to take credit for Dow 20,000, and as long as stocks keep rising, nobody will complain or contest. But how will traders and politicians react after the first 5% or 10% correction, the first bear market, and soon thereafter, an economic collapse because without central banks injecting another $14 trillion in liquidity, real economic price discovery will finally happen. With Trump's tendency to accelerate all timelines, we won't have long to wait to find the answer.

FOR MORE ON THIS ARTICLE, PLEASE VISIT: http://www.zerohedge.com/news/2017-01-28/barrons-cover-next-stop-dow-30000-one-condition

by Tyler Durden

Jan 28, 2017 11:08 AM

The financial magazine which has made an art out of calling for big, round numbers in the Dow Jones Financial Index (as a reminder over 20% of the Dow's surge since the election is due entirely to Goldman Sachs), most recently with its "get ready for Dow 20,000" call from just over a month ago, has done it again:

While there are still those - pretty much anyone who still cares about fundamentals - who are scratching their heads at Dow20K, according to Barrons "the Dow hitting 20,000 was no fluke. Today’s stock prices are well supported by solid prospects for corporate earnings and economic growth."

In fact, Dow 30,000 is just around the corner... well by 2025. All President Donald Trump has to do, according to Barron's, is "avoid stumbling into a trade war—or a real war." Some of the profound insight behind this forecast so reminiscent of the infamous "Dow 36,000" prediction which hit just around the time of the last market bubble.

Clearly, part of the propulsion behind stocks has been the Trump administration and its flurry of business-friendly edicts. If Trump can succeed in reducing regulation and lowering corporate taxes, stocks should surge further this year. An additional 5% or even 10% gain in 2017 wouldn’t be surprising. Our projection of 30,000 by 2025 is based on our analysis of historical data provided by Jeremy Schwartz, director of research at WisdomTree. This data, which looks at stock market returns for rolling five-year periods dating back to 1871, suggest stock market gains will fall below the market’s typical annual gain of 6% after inflation in the next five years before accelerating above the average in the years after that.

Then again, perhaps Dow 30,000, which would require China to inject in at least another $30 trillion in debt in the next decade without somehow hitting the Minsky moment tipping point, is not so certain: it all depends on whether Trump can avoid war, either literal of metaphorical:

"a few of the new administration’s policies pose a serious threat to the economy and stock market. The most evident one last week was the trade spat with Mexico, with the White House at one point floating the idea of a 20% border tax on Mexican goods entering the U.S. If Trump gambits like this were to trigger a trade war, the world economy would suffer. The Dow would have a hard time getting to 30,000 by 2025."

Alternatively, one can make the argument that a trade, or real war, would guarantee hitting the Dow 30,000 that much quicker: after all, it would force the Fed to resume QE, monetizing not just bonds, but ETFs, equities, and everything else in capital markets in order to preserve confidence in the global financial system.

Ironically, in the same Barron's edition, we also read a more nuanced take of what Dow 20,000 really means from Randall Forsyth who notes says that "while the Dow is the gauge that regular folks use to keep track of the stock market, a columnist in the Financial Times condescendingly called the attainment of the 20,000 mark last week “fake news.” The flaws in the price-weighted DJIA are known to anyone who cares about such things, but it was the best method available to Charles Dow before the turn of the 20th century. As a result of its modus operandi, David Rosenberg, chief economist and strategist at Gluskin Sheff, observes that moves in Goldman Sachs Group (ticker: GS) have eight times the impact on the Dow as those in General Electric (GE).

So-called survivorship bias also has benefited the Dow. Since April 2004, Dave found that, if the eight companies that were replaced in the DJIA had been kept on, the blue chips would have been at just 12,885 now. That date, by the way, is the furthest back he could go to find former Dow companies that are still around. In the process, Apple (AAPL) was added in 2015, after a seven-for-one stock split that prevented the tech giant from having an outsize impact on the DJIA. While Rosenberg notes that tech stocks now account for a quarter of the Dow, up from 2% at the peak of the dot-com boom in 1999, the so-called FANG stocks— Facebook (FB), Amazon.com (AMZN), Netflix (NFLX), and Google parent Alphabet (GOOGL)—wait to be admitted to the blue chips.

Not surprisingly, President Donald Trump was more than willing to take credit for the Dow’s hitting 20,000 five days into his administration (arguably more deserved than President Barack Obama getting the Nobel Peace Prize months after taking office in 2009)—a reversal of his declaration that the market was in a “fat bubble” last September.

To a more dispassionate observer—in this case, Peter Berezin writing in the BCA Research Global Investment Strategy—the shift represented an evolution from undue pessimism about global growth to unbridled optimism.

And, as JPM has warned every single day in the past month, the next step in the market climbing the wall of optimism may be slippery:

The centerpiece of the Trump program—tax cuts and tax reform—can’t be enacted by executive order. That will take approval by Congress. However, the White House has widening rifts with GOP leaders, writes Greg Valliere, chief strategist at Horizon Investments and a four-decade Washington watcher: “Make no mistake—[House Speaker] Paul Ryan and [Senate Majority Leader] Mitch McConnell can’t stand Trump, and the feeling is mutual.”

While the Dow has been happy to stay above 20K for the time being, the next step may be determined by the Fed, which is meeting next week with the S&P over 200 points above where Janet Yellen warned sstocks are overvalued. As the Fed chair said in May 2015, "I would highlight that equity market valuations at this point generally are quite high," Yellen said.

"There are potential dangers there" Yellen said.

And the main one is that Yellen decides to finally pull the rug from under Trump's market honeymoon. As Forsyth writes, "the FOMC could signal its readiness to raise its fed-funds target at the March 14-15 meeting. The fed-funds futures market puts only a 34.6% probability on a March move, according to Bloomberg’s analysis, instead pricing in the next boost for June and another in September, but not in December. The shock for the markets would be if the central bank actually delivers the three rate increases that it has signaled."

Trump was quick to take credit for Dow 20,000, and as long as stocks keep rising, nobody will complain or contest. But how will traders and politicians react after the first 5% or 10% correction, the first bear market, and soon thereafter, an economic collapse because without central banks injecting another $14 trillion in liquidity, real economic price discovery will finally happen. With Trump's tendency to accelerate all timelines, we won't have long to wait to find the answer.

FOR MORE ON THIS ARTICLE, PLEASE VISIT: http://www.zerohedge.com/news/2017-01-28/barrons-cover-next-stop-dow-30000-one-condition

Similar topics

Similar topics» ZERO HEDGE - ANGRY PROTESTERS DEMAND THAT TRUMP "STOP ATTACKING WOMEN, MUSLIMS, IMMIGRANTS, LGBTQ+ JOURNALISTS" ...

» WHAT IS THE UK ECONOMIC CONDITION????

» WESTERN JOURNALISM - SCABIES'S CONDITION UPGRADED TO FAIR

» STEVE QUAYLE - NEW!! "PREPARE FOR WAR!!" CONDITION ZEBRA | MUST WATCH!

» ZERO HEDGE - WHAT'S TRULY PROGRESSIVE?

» WHAT IS THE UK ECONOMIC CONDITION????

» WESTERN JOURNALISM - SCABIES'S CONDITION UPGRADED TO FAIR

» STEVE QUAYLE - NEW!! "PREPARE FOR WAR!!" CONDITION ZEBRA | MUST WATCH!

» ZERO HEDGE - WHAT'S TRULY PROGRESSIVE?

END TIME NEWS, A CALL FOR REPENTANCE, YESHUA THE ONLY WAY TO HEAVEN :: CHRISTIANS FOR YESHUA (JESUS) :: ZERO HEDGE

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum

Sun 29 Aug 2021, 22:15 by Jude

Sun 29 Aug 2021, 22:15 by Jude